Payroll calculator usa

Pay employees by salary monthly weekly hourly rate commission tips and more. Your average tax rate is.

Income Percentile Calculator For The United States

Compare - Message - Hire - Done.

. Gross pay is the amount of pay an employee earns before any taxes and deductions are taken out while net pay is the amount an employee receives after taxes and deductions are taken out. Get a free quote today. The standard FUTA tax rate is 6 so your max.

Free calculator to find the actual paycheck amount taken home after taxes and deductions from salary or to learn more about income tax in the US. This free paycheck calculator makes it easy for you to calculate pay for all your workers including hourly wage earners and salaried employees. Payroll management made easy.

Subtract any deductions and. The Tax Calculator uses tax information from the tax year 2022 to show you take-home pay. Using the United States Tax Calculator is fairly simple.

Free Unbiased Reviews Top Picks. See where that hard-earned money goes - with Federal Income Tax Social Security and other. Using 10 holidays and 15 paid vacation days a year subtract these non-working days from the total number of.

Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more. Thumbtack - find a trusted and affordable pro in minutes. Using the United States Tax Calculator.

Ad Process Payroll Faster Easier With ADP Payroll. Ad Modern teams use Remote. Youll then get a breakdown of your total tax liability and take-home pay.

2020 Federal income tax withholding calculation. If you make 55000 a year living in the region of New York USA you will be taxed 11959. Ad Accurate Payroll With Personalized Customer Service.

Remote is your local expert for international employee benefits. Weekly bi-weekly semi-monthly and monthly. Ad Compare This Years Top 5 Free Payroll Software.

Ad Top-rated pros for any project. All inclusive payroll processing services for small businesses. Small Business Low-Priced Payroll Service.

The FREE Online Payroll Calculator is a simple flexible and convenient tool for computing payroll taxes and printing pay stubs or paychecks. Leading EOR offering global payroll benefits and compliance. Discover ADP Payroll Benefits Insurance Time Talent HR More.

The Texas Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Texas State Income. Our free payroll tax calculators make it simple to figure out withholdings and deductions in any state for any type of payment. Everything You Need For Your Business All In One Place.

Ad Process Payroll Faster Easier With ADP Payroll. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Find out how easy it is to manage your payroll today.

This number is the gross pay per pay period. To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. Growing a global team.

If its time to pay your employees youre in the right place. Computes federal and state tax withholding for. The United States US Salary Calculator is a versatile salary calculator that allows you to calculate your salary after tax in any state in the United States.

Get a free estimate today. Next select the Filing Status drop down. Simply enter your annual or monthly income into the tax calculator above to find out how US taxes affect your income.

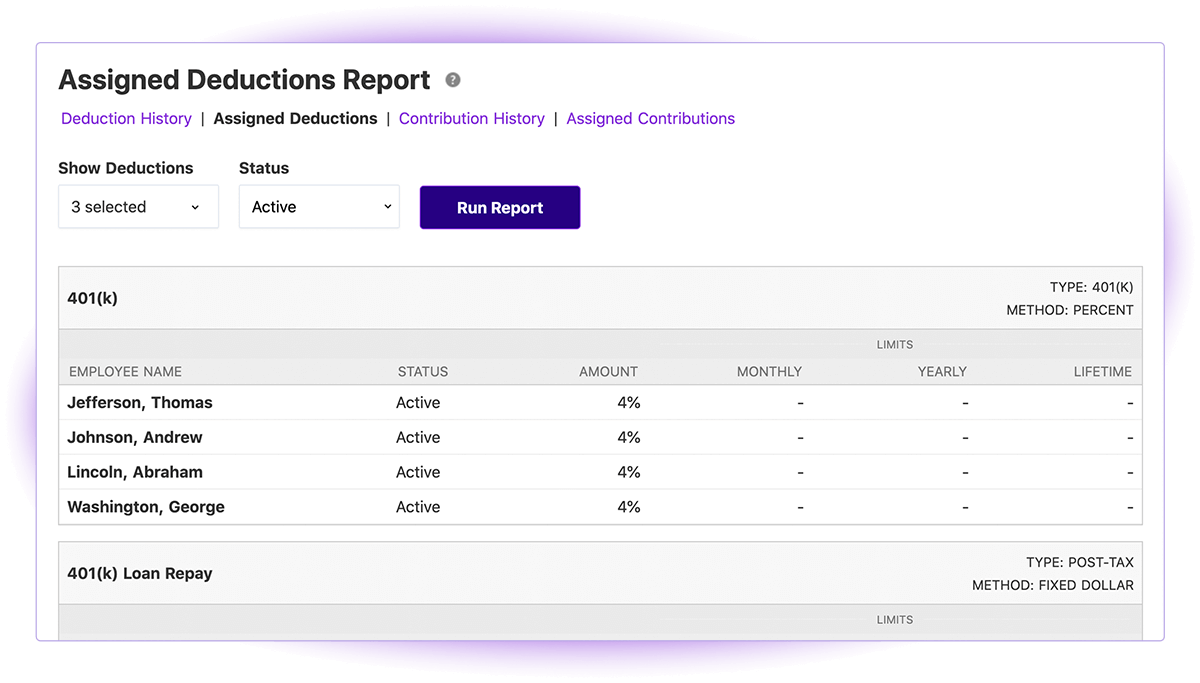

First enter your Gross Salary amount where shown. Use this calculator to help you determine the impact of changing your payroll deductions. Heres a step-by-step guide to walk you through.

Gross Pay Calculator Plug in the amount of money youd like to take home. That means that your net pay will be 43041 per year or 3587 per month. Hourly Paycheck Calculator Enter up to six different hourly rates to estimate after-tax wages for hourly employees.

Ad Payroll Done For You. Total annual income Tax liability. Get a free quote today.

Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. Get Started With ADP Payroll. Subtract 12900 for Married otherwise.

Ad Calculate tax print check W2 W3 940 941. The Viventium free payroll calculators make it easy to calculate withholdings and deductions in any state. You can enter your current payroll information and deductions and then compare them to your.

Ad Payroll So Easy You Can Set It Up Run It Yourself. Starting as Low as 6Month. 3 Months Free Trial.

Once you have worked out your tax liability you minus the money you put aside for tax withholdings every year if there is any. Taxes Paid Filed - 100 Guarantee. Start free trial with no obligation today.

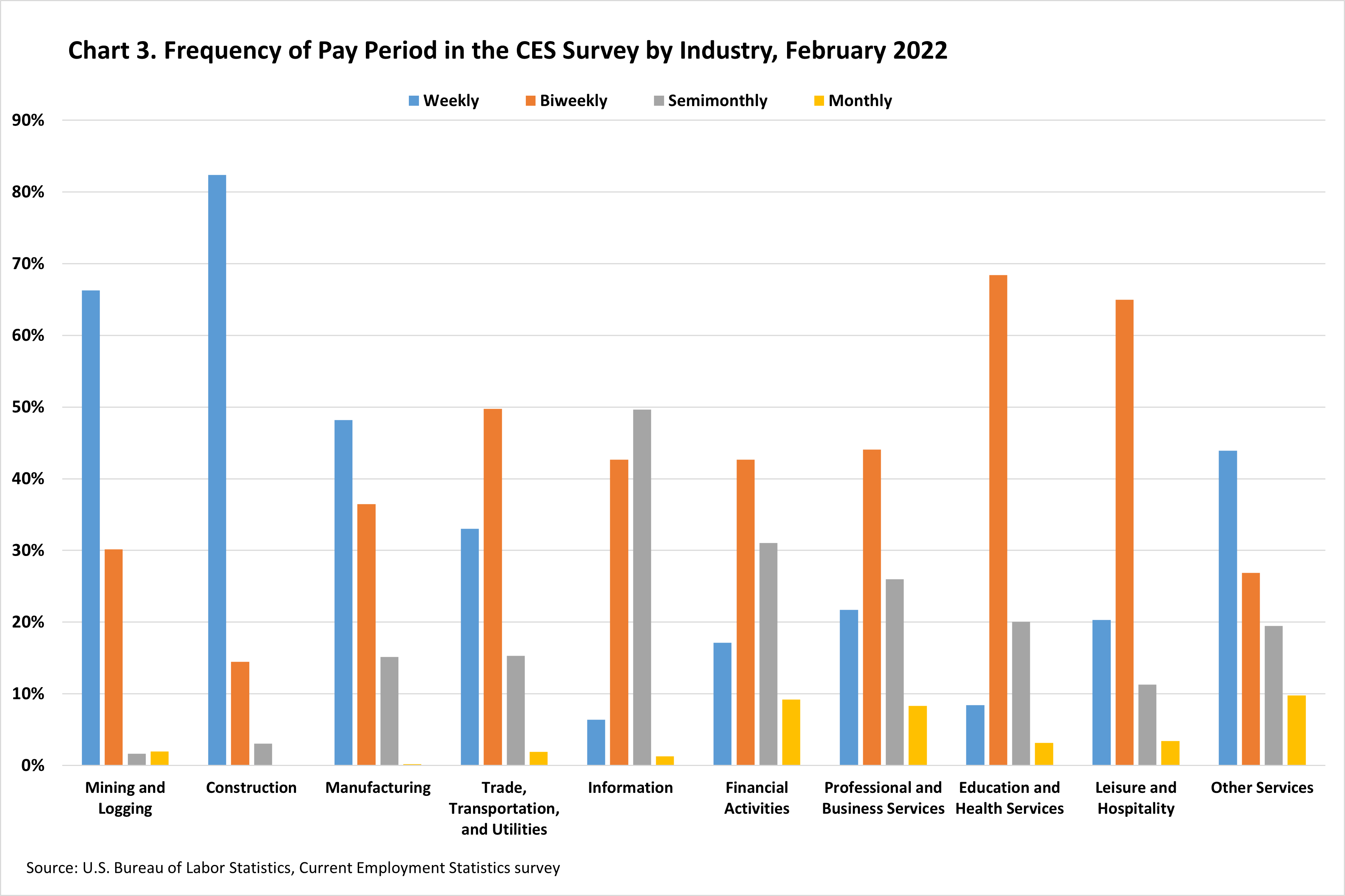

Examples of pay periods are. Use these calculator tools to help you determine the impact of changing your payroll. The Best Online Payroll Tool.

By default the US Salary. 30 8 260 - 25 56400. Can be used by salary earners self.

The adjusted annual salary can be calculated as. Discover ADP Payroll Benefits Insurance Time Talent HR More. Get Started With ADP Payroll.

FUTAs maximum taxable earnings whats called a wage base is 7000 anything an employee earns beyond that amount isnt taxed. A pay period is a recurring length of time over which employee time is recorded and paid.

How To Calculate Payroll Taxes Methods Examples More

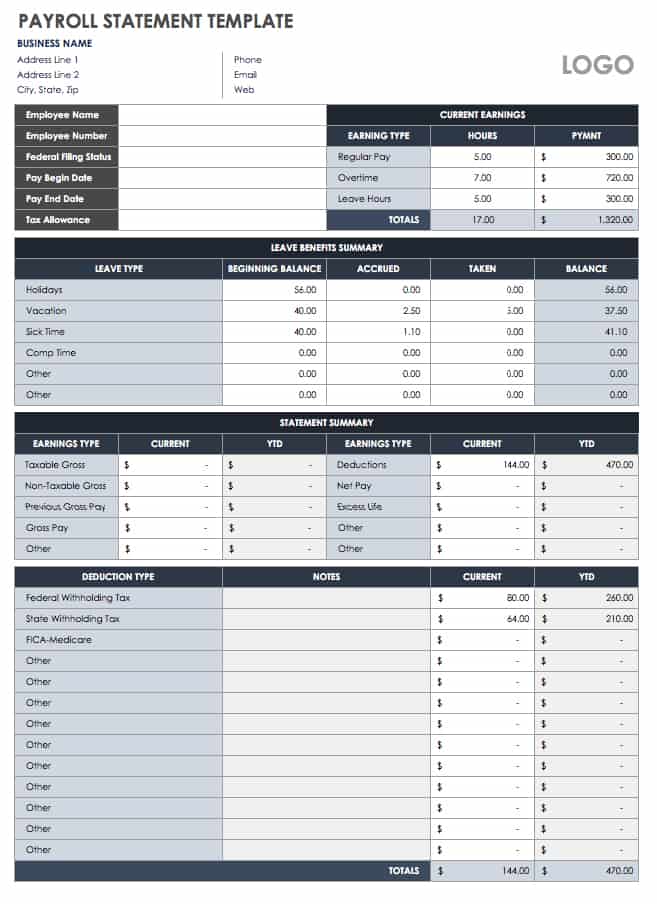

Payroll Template Free Employee Payroll Template For Excel

Overtime Calculator

How To Do Payroll In Excel In 7 Steps Free Template

Payroll Formula Step By Step Calculation With Examples

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

How A Payroll System Works

15 Free Payroll Templates Smartsheet

Hourly To Salary Calculator Convert Your Wages Indeed Com

How To Do Payroll In Excel In 7 Steps Free Template

Length Of Pay Periods In The Current Employment Statistics Survey U S Bureau Of Labor Statistics

Hourly To Salary Calculator

Hourly Paycheck Calculator Calculate Hourly Pay Adp

Online Payroll For Small Business Patriot Software

15 Free Payroll Templates Smartsheet

Payroll Formula Step By Step Calculation With Examples

How To Calculate Payroll Taxes Methods Examples More